pa local tax due dates 2021

On or Before May 6 2022. LS-1 Local Services Tax 12 December January 31.

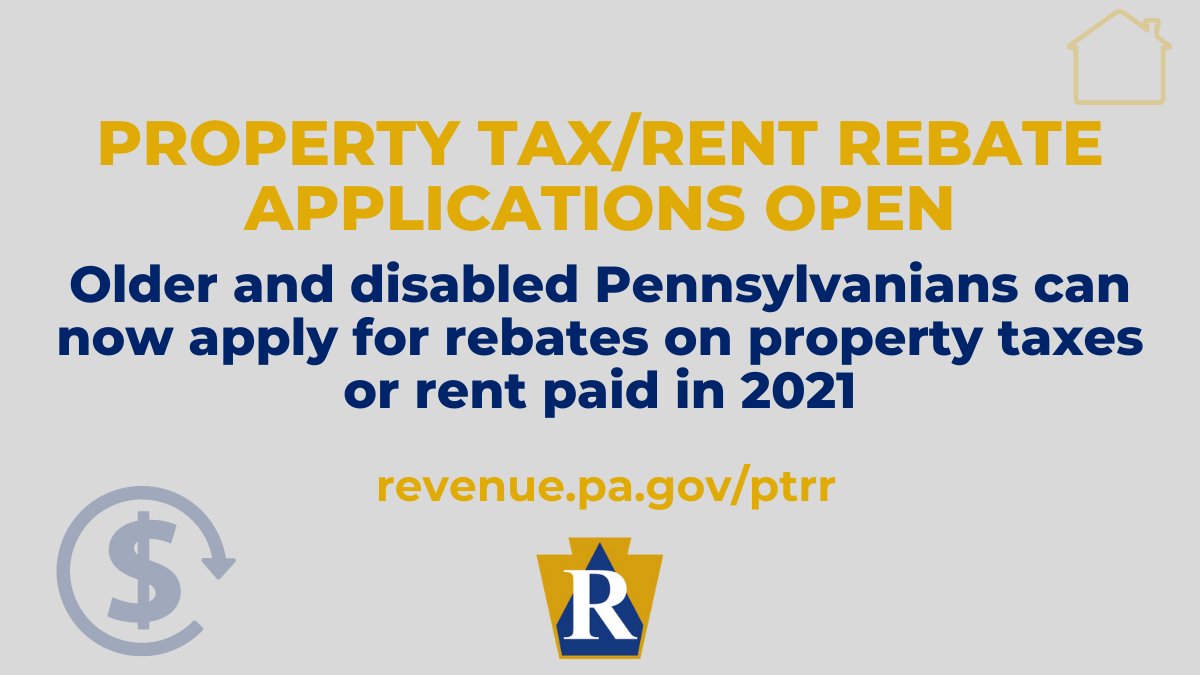

Pennsylvania Department Of Revenue

To remain consistent with the federal tax due date the due date for filing 2021 Pennsylvania tax returns will be on or before midnight Monday April 18 2022.

. Pay all of the estimated tax by Jan. 11 rows BLAIR TAX COLLECTION DISTRICT. This means taxpayers will have an.

Harrisburg PA The Department of Revenue is reminding the public that the deadline for filing 2020 Pennsylvania personal income tax returns and making final 2020 income tax payments is May 17 2021. Pennsylvania Extends Personal Income Tax Filing Deadline to May 17 2021. PT Parking Tax 12 December January 15.

4th Quarter - January 15th. PENNSYLVANIA TAX DUE DATE REFERENCE GUIDE PAGE 1 2022 STATE TAX DUE DATE REFERENCE GUIDE Continued on Page 2 CIGARETTE TAX CONSUMER FIREWORKS TAX CORPORATION TAXES - CORPORATE NET INCOME TAX Jan. If applicable provide your local tax ID number to your payroll service provider.

The postmark determines date of mailing. FORM TAX TYPE TAX PERIOD DUE DATE. If the 15th falls on Saturday Sunday or holiday the due date would be extended to the next business day.

While the PA Department of Revenue and the IRS announced. 18 December 2021 Cigarette Stamping Agent CSA Stamp Payment Jan. Harrisburg PA The Department of Revenue today announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and make final 2020 income tax payments is extended to May 17 2021.

Tax Day deadline is April 15 unless the date falls on a weekend or holiday then it is the next business day. 1st Quarter - April 15th. TAX FORGIVENESS Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program.

Penalty and interest that already accrued prior to April 15 2021 remains due. Fiscal Year Feb 2021 - Jan 2022. Start Date End Date Due Date.

The local earned income tax filing deadline is accordingly extended to match the State and Federal date of May 17 2021. Withhold and Remit Local Income Taxes. The personal income tax filing deadline was originally set for today April 15 2021 but the department in mid-March announced an extension to May 17.

All forms listed below should be filed with the City of Pittsburgh. In this case 2021 estimated tax payments are not required. Fiscal Year Mar 2021 - Feb 2022.

AMENDING ESTIMATED TAX PAYMENTS An individual that has a change in income or credits during a tax year may be required to or elect to change or amend. May 7th July 8th 2022. Start Date End Date Due Date.

July 9th December 31st 2022. UF-1 Non-Resident Sports Facility Fee 4. That is Keystone will not apply late-filing penalty and interest on tax year 2020 final returns filed between April 15 2021 through May 17 2021.

2nd Quarter - June 15th. Blair County Tax Collection. Estimate due dates are.

AT Amusement Tax 12 December January 15. Annual Earned Income Tax Reconciliation. Keystone Collections said today The Local Earned Income Tax filing deadline has NOT been extended beyond the April 15 2021 due date.

April 15 of the following year. Fiscal Year Dec 2020 - Nov 2021. On March 17 2021 the Internal Revenue Service IRS announced that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021.

Understanding The Extended Tax Deadline In Pennsylvania. Or File a 2021 PA tax return by March 1 2022 and pay the total tax due. Taxpayers should write 2021 Estimated Tax Payment and the last four digits of the primary.

The quarterly due dates for personal income tax estimated payments are as follows. Quarterly Earned Income Tax Return and Payment. Individual taxpayers can request a filing extension until October 15 2021 if they need additional time to file beyond the.

PITTSBURGH KDKA - It is April 15th but that carries a different. 10 December 2021 PACT Act Report Jan. Quarterly filings and remittances are due within 30 days after the end of each calendar quarter.

E-Tides Tax Due Dates. The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated Tax coupon to the department along with their check for the estimated tax amount. Fiscal Year Nov 2020 - Oct 2021.

April 15 2021 710 AM CBS Pittsburgh. 3rd Quarter - September 15th. 2021 Personal Income Tax Forms.

Employer Withholding Tax Annual. Most often quarterly filings and remittances can be made directly through the local tax collectors website.

Pennsylvania Sales Tax Small Business Guide Truic

Where S My Refund Pennsylvania H R Block

Certified Valuation Analyst In 2021 Cpa Accounting Accounting Firms Income Tax Preparation

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Department Of Revenue

Solar Energy Data Making The Decision To Go Environmentally Friendly By Changing Over To Solar Panel Technology Is Solar Energy Renewable Energy Solar Panels

Pennsylvania Property Tax H R Block

Blue Summit Supplies Tax Forms W2 6 Part Tax Forms Bundle With Self Seal Envelopes Tax Forms Small Business Accounting Software Business Accounting Software

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Department Of Revenue Parevenue Twitter

Donate Helpful Accessible House Nicene Creed

Pennsylvania Department Of Revenue

Pennsylvania Department Of Revenue

What Is Local Income Tax Types States With Local Income Tax More

State Corporate Income Tax Rates And Brackets Tax Foundation

.png)